China’s overall economic growth is slowing, but the Chinese consumer economy is still massive in absolute terms and poised for increasing growth. The country will see nearly AU$2.6 trillion in new consumption by 2021—about 27% of the total consumption growth that will occur in major economies during that time. China thus represents one of the biggest opportunities for consumer companies in the world for the foreseeable future.

To help multinational corporations understand this opportunity, we recently partnered with Alibaba to analyze the country’s potential consumer growth. (The project follows up on our previous research on the topic; see The New China Playbook: Young, Affluent, E-savvy Consumers Will Fuel Growth, BCG Focus, December 2015.) Our updated data and analyses confirm that many of the trends we identified in 2015 remain in play. For example, much of the new consumption growth will continue to come from upper-middle-class and affluent households, the younger generation, and e-commerce.

The large-scale trends reflect the broader driving forces behind consumption growth in China. However, identifying these trends is not enough. Companies need to drill down and look at more-granular information to understand how these trends affect the shopping habits and behaviors of Chinese consumers. To that end, we identified five emerging-consumer profiles that serve as examples of how rising incomes and greater digital access are leading to a far more heterogeneous consumer market. They illustrate in specific detail the ways in which large-scale trends affect specific consumer segments. A deep understanding of these segments will be critical as China’s consumer economy matures.

CONSUMPTION CONTINUES TO GROW

In our 2015 publication, we discussed how consumption in China was holding up despite macroeconomic forces that threatened to restrict it. That bears repeating. Despite some fluctuations from one quarter to another, China’s overall GDP continues to grow at less than 7% a year but consumption is increasing by more than 10% annually, largely because of structural shifts in the Chinese economy.

Even if GDP growth was to slow to 5.5%—a conservative projection—the country would still add a cumulative AU$2.4 trillion in new consumption by 2021, to reach AU$8 trillion. (See Exhibit 1.) China’s consumer market, both currently and as projected for 2021, is the world’s second largest, behind only the US. In fact, the projected growth in China through 2021 is equivalent to adding another consumer market the size of Germany’s.

Three factors are the primary drivers of future consumer growth: China’s emerging upper-middle-class and affluent households, the spending habits of the younger generation, and the increasing role of omnichannel e-commerce. (See Exhibit 2.)

Growth in the Number of Upper-Middle-Class and Affluent Families

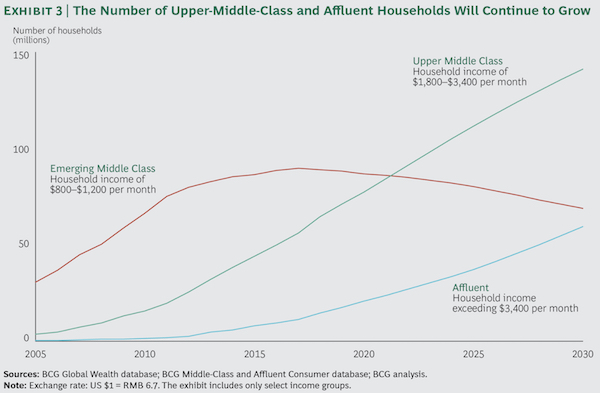

Income levels in China are rising, so the population of upper-middle-class and affluent families is rising as well. (See Exhibit 3.) These households have more accumulated wealth, and that leads to increased spending in discretionary categories such as furniture and home decoration, travel, and entertainment.

Moreover, consumers in these households are not just buying more, they are trading up: buying higher-quality products in certain categories, such as electronics, food, apparel, and children’s products. According to AliResearch’s “New Consumption Index” report, published in China in April 2017, consumption of midlevel to high-end products on Alibaba’s retail site reached $174 billion in 2016. In addition, AliResearch’s quality index showed an increase of 7.2 percentage points over the past five years, even as quantities declined.

The Purchasing Habits of the Younger Generation

As in developed countries, the younger generation in China (people aged 18 to 35) shows a greater appetite for consumer goods. In 2016, this group made 1.5 trillion dollars’ worth of purchases (up from AU$922 billion in 2011), and projections call for a continued sharp rise in their spending, to AU$3.4 trillion in 2021, reflecting a compound annual growth rate of 11%, compared with a CAGR of just 5% for purchases made by consumers aged 36 or older. (See Exhibit 4.) At that point, aggregate consumption by the younger generation will exceed that of older age groups in China. More